Whether it’s office technology like copiers and printers, managed IT services, smart security devices, or digital communication tools, RJ Young has you covered. We’re here to help you transition your existing workplace into the modern office.

A modern office needs to be smart. It must integrate technology as a business advantage. Meaning, it must make employees’ day-to-day processes easier, faster, and more sophisticated. All to improve efficiency and outcomes.

That’s where RJ Young comes in. We’re your one-stop for technology solutions that power your business. And, with our process-first approach, we’ll ensure these technological assets are customized to your organization and work in synchronization for optimal gains and cost savings.

An industry leader for almost 70 years, small to enterprise-level businesses rely on RJ Young for all business imaging needs.

View MoreWhen you control the print job, you can ensure the image quality, color, paper stock, bindery, speed, deadline and volume. Bring print projects in-house with production printers.

View MoreWiden your printing capabilities and create high-quality print pieces in-house.

View MoreStore, organize, and manage everyday business documents and files in a digital format.

View MoreAudio visual solutions have become a natural, necessary means of progression that all organizations should prioritize to improve communication.

View MoreOur business security camera systems are limitlessly smart, scalable and simple to use. With hybrid cloud technology, facial recognition and environment sensors there’s no compromise in reliability and flexibility.

View MoreEnsure contactless delivery of mail, packages, medical supplies, food, and more.

View MoreShred or destroy sensitive, no-longer-necessary information. Various solutions meet all your data destruction needs.

View MoreSimplify customer mailings with our print services and mailing equipment which includes paper folders, pressure sealers, mailing optimization technology and more.

View MoreWe offer network and physical security systems, digital mailrooms, and more to enhance productivity as you work remotely.

View More

Running a business requires a multitude of behind-the-scenes operations, personnel, software, and more. Let us take those admin and workflow off your plate so you can do what you got in business to do.

View MoreWe offer on-site facility management of copy centers, print shops, equipment management, staffing solutions, mailroom services, and much more. All so you can focus on your business rather than being mired in it.

View MoreStay in your A-time by allowing our managed print experts to. manage your organization’s print equipment-including supply orders, interruptions, updates, and networking.

View MoreDigitize your business’ physical mail and reroute the rest. You’ll improve customer service and stay on top of AP and AR when you digitize your mailroom.

View MoreKeep your brand top-of-mind. We offer a full line of unique and high-quality, branded merchandise for all your promotional needs.

View MoreWhen specialized or bulk printing isn’t the norm, additional personnel and equipment aren’t feasible, or you’re using multiple outlets to get various prints made – outsource with our team of dedicated print experts.

View More

Ensure your network is secure and efficient. Let us be your trusted advisors. With 97% customer retention and dedicated experts in network security and more, rely on us to manage or augment your IT.

View MoreWhether it’s infrastructure support and planning or helpdesk and end-user support, we can build a solution to help meet your organization where you need it most.

View MoreLet us help you strengthen your security posture by leveraging advanced solutions.

View MoreRegulatory and insurance requirements continue to expand, our team can help you take practical steps to meet your industry requirements.

View MoreFrom servers to firewalls to email we can help you minimize your local hardware needs by providing support and cloud-hosted solutions.

View MoreBe prepared in the case of an event with solutions designed to keep your critical systems up and running and a plan to get you back to normal operations.

View MoreOur internal support desk team is located locally and here to support your team when needed.

Transform your meetings and classrooms while encouraging engagement, innovation, and hands-on collaboration with interactive whiteboards and displays.

View MoreEliminate dedicated landlines and integrate voice, messaging, video, and more with cloud-based collaboration platform.

View MoreFrom digital indoor signs and displays to video walls and video conferencing – we can help with all your AV needs.

View MoreWith more than 30 locations throughout the Southeast, we’re able to provide cutting-edge solutions while ensuring the personalized support your corner of the South deserves. Find an RJ Young location near you. Then, reach out. We’re looking forward to learning how we can help pinpoint the technology solutions that will power your business.

100 Dalton Place Way Ste 101

(865) 573-5303

4000 Pemberton Blvd Suite A

909 Iowa Street

540-389-4400

2875 Nathan Street

105 Pine Street

(318) 855-2221

5914 Provine Place

(800) 347-1955

10231 Cogdill Road Unit 101

(865) 622-6379

2025 SW 75th Street #10

(352) 415-2478

4305 Enterprise Dr. Suite D

(336) 788-2100

1121 Volunteer Parkway

(800) 654-7687

4815 Executive Park Court, Bldg 200 Suite 207

(904) 257-1016

895 Lagoon Commercial Blvd

(334) 230-5107

1141 Montlimar Drive Suite 2008

(251) 259-5778

4001 Farr Road

205-847-5465

3702 Northwest Passage

(850) 523-4450

14231 Seaway Road Suite 1001

(228) 388-3667

824 Creighton Rd

(850) 433-8655

130 JM Tatum Industrial Drive

(601) 264-3939

2030 NW Progress Parkway

(601) 948-2222

3141 Stagepost Drive

(901) 373-6331

100 Briar Ridge Road

(662) 840-6973

12 Felton Pl Suite C Suite 216

(678) 719-0904

256 Vann Dr

(731) 664-5577

4626 Resource Drive Suite 106

(423) 443-3144

7262 Governors West Suite 108

(256) 270-0335

1435 South Jefferson Street Suite A

(931) 526-3300

996 Wilkinson Trace, Suite B-5

(270) 776-9848

221-A West Dunbar Cave Road

(931) 250-8596

725B South Church Street

(615) 900-2005

730A Freeland Station Road

(615) 255-8551

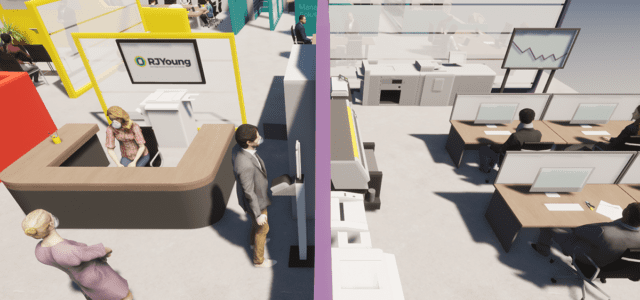

Step inside the interactive Modern Office. Learn about the technology solutions that will power your business. You’ll find business phone systems, managed IT services, smart security systems, business process outsourcing, and more.

Have a personal 1-on-1 conversation with one of our amazing, awesome service team members.

With more than 30 locations throughout the Southeast, we’re able to provide cutting-edge solutions while ensuring the personalized support your corner of the South deserves. Find an RJ Young location near you. Then, reach out. We’re looking forward to learning how we can help pinpoint the technology solutions that will power your business.

These are the key technology solutions most businesses are implementing to increase productivity and alignment in their modern offices.